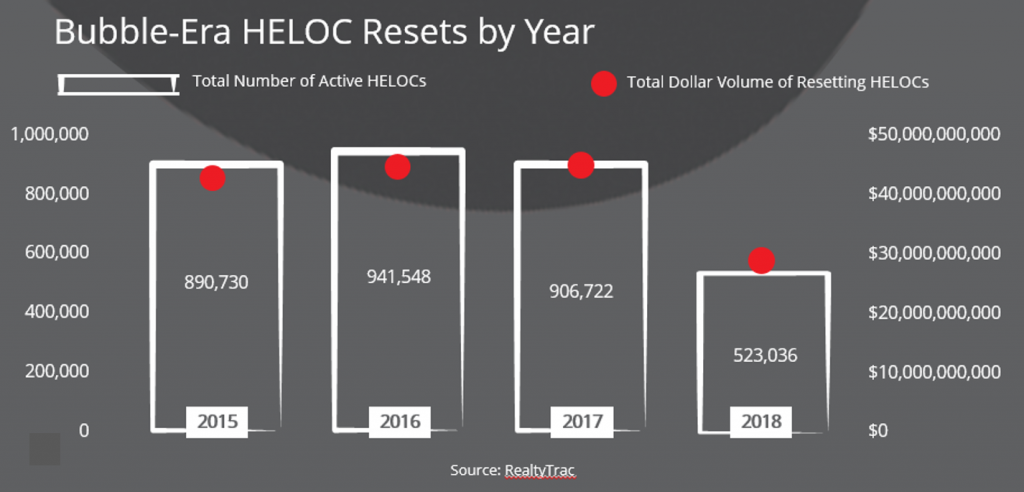

If you haven’t tackled your home equity line of credit (HELOC) reset loans yet, now is the time. The market has entered the peak volume period for 10-year HELOCs coming due – $158B worth of HELOC loans will need to be paid off or renewed over the next 3 years (including 2016!).

If you haven’t tackled your home equity line of credit (HELOC) reset loans yet, now is the time. The market has entered the peak volume period for 10-year HELOCs coming due – $158B worth of HELOC loans will need to be paid off or renewed over the next 3 years (including 2016!).

HELOC reset warnings were issued two years ago, but action taken by lenders was mixed. If you haven’t taken action yet, now is the time.

Earlier this month, the Wall Street Journal summed up the challenge facing banks in its article titled: “Home Equity Loans Come Back to Haunt Borrowers, Banks.” The sense of urgency is clear:

- Approximately 840,000 HELOCs taken out in 2006 are resetting in 2016

- In 2017, there will be another one million HELOC loans expected due

- Borrower default rates are rising on HELOCs – borrowers who signed up for HELOCs in early 2006 were at least 30 days late on $2.8 billion of balances four months after principal payments hit in 2016 (source: Equifax)

- Delinquencies on HELOC reset loans this year rose to 4.4% vs. 2.9% before the reset

To make this even more painful, RealtyTrac estimates that $88B of the $158B in HELOC resets over the next few years are underwater homes – that’s 56%!

For banks, credit unions and other home equity lenders, the challenge with HELOC reset loans is that you may have thousands (or hundreds of thousands) of them, and new regulations require that each expiring HELOC be treated as a new loan. This means going through the entire loan origination, property valuation and closing process across a huge volume of loans. For the largest lenders, these loans represent millions of dollars of assets, so your business is at risk. You need to tackle them now to lower your risk of delinquencies and seize the opportunity to retain your best customers, especially as your competition ramps up home equity marketing efforts.

To help you accelerate and streamline the process of managing HELOC resets, consider going with a solution provider who specializes in this process. The investment will save you time and money in the long-run, and potentially help you retain your best customers before your competitors snatch them away. In addition, partnering with a firm to help you assess, organize and re-appraise the properties tied to these loans will ensure that compliance is built in to the process. Finally, the time you gain back can be applied to marketing within your existing customer base, providing exceptional customer service and engaging in business development efforts to win new clients – all of which contribute to growth and profitability.

Accurate Group has developed a turnkey HELOC renewal solution designed specifically to help banks, credit unions and other home equity lenders address HELOC resets in an efficient, effective and compliant manner. Accurate EquityRenew combines technology, processes and data analysis to quickly and thoroughly evaluate each HELOC, identify red flags related to title and property liens and issue an accurate and compliant appraisal on each property. As the lender, you are provided with a report and online dashboard that scores each loan so that you can focus your efforts on the highest priorities and take the appropriate action needed for each HELOC.

Here are 3 resources to get you started:

- An eBook exploring some of the challenges and opportunities that HELOC resets present

- An infographic outlining how the Accurate EquityRenew solution works and the value you gain

- An overview of the Accurate EquityRenew solution

After you’ve explored these resources, please contact us to discuss your specific needs.

As the leading home equity appraisal, title and compliance company nationwide, Accurate Group is uniquely positioned to help your firm navigate successfully through this challenge. We have proven technology, processes and experts in place, so you can be confident in letting us handle your HELOC assessments – while you can stay focused on client service and growing your business.

Back to Blog