In the past, there has been 3% cap on home equity loan fees in Texas. With steep violations for non-compliance, many lenders limited volumes or avoided home equity loans altogether.

In the past, there has been 3% cap on home equity loan fees in Texas. With steep violations for non-compliance, many lenders limited volumes or avoided home equity loans altogether.

But as of November 7, 2017, a new Texas state amendment (Proposition 2) passed that lowers this risk – opening up an opportunity for lenders to increase revenues from home equity loans. The Proposition 2 Home Equity Loan Amendment makes 4 significant changes to home equity lending in Texas:

- lowers the cap on home equity loan-related fees from 3 to 2 percent, BUT the cap now excludes certain mandatory fees paid to third parties, including appraisal fees

- allows home equity loans against agricultural property

- allows the refinancing of a home equity loan with a purchase money loan

- allows advances on a home equity line of credit (HELOC) as long as the principal amount remains below 80 percent of the fair market value of a borrower’s house (homeowners will be able to refinance a home equity loan into a conventional loan)

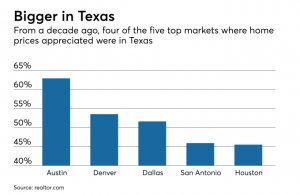

The passing of Proposition 2 sets the stage for real estate lenders to increase home equity lending in Texas.

Accurate Group is currently the #1 provider of home equity appraisal and title solutions nationwide. In addition, the team at Accurate Group of Texas has the expertise you need to ensure compliance with Texas-specific appraisal, title and settlement requirements.

Contact Accurate Group today to get started on increasing your home equity revenues in Texas.

Back to Blog