Part 1 of 3-Part NotaryWorks™ Blog Series

Online closings are becoming the norm as lenders look for ways to innovate old processes and leverage technology to deliver greater value to their borrowers. NotaryWorks offers lenders a complete e-closing solution to accelerate loan closings and improve the borrower experience.

With NotaryWorks you get the best of both worlds – the latest in online, remote e-notarization technology, plus the added choice of mobile notaries for those who prefer an in-person approach but don’t want to leave their home or office.

The quality of a notary can make or break the borrower experience – so how does Accurate Group ensure that our notaries are the best in the field? We take a 3-step approach to delivering notary excellence with continuous performance monitoring along the way.

Step 1: Notary Assignment Selection Process

Accurate Group’s vendor management team chooses only experienced closing agents to conduct closings for our lender clients. We leverage the National Notary Association (NNA) database, lender recommended notary contacts and various other state and national notary association resources to identify and invite qualified notaries and attorneys to join our national notary panel.

We have access to approximately 20,000 NNA Certified notaries in all 50 states and the District of Columbia. All notaries engaged by Accurate Group are certified and pre-screened and managed on our proprietary vendor management system.

Our Notary Standards

Accurate Group requires a Notary Panel member to be NNA certified. NNA certified notaries are bound by the NNA Code of Conduct to guide professional standards for appearance and behavior during real estate closings. Below are the requirements we set forth for each notary assigned to a closing:

- Proof of active notary commission

- Proof of state issued title insurance producer or closing agent license (where applicable)

- Proof of National Notary Association active certification

- Proof of valid driver’s license

- Copy of active background check (less than 12 months from issue date)

- Copy of Errors and Omissions insurance binder and/or Bond

- Copy of W-9 tax form

- Resume and references upon demand

- Minimum quality score of 4.5 out of 5 (see Quality Scoring below)

- Notary will not engage in any activity that constitutes gross misbehavior, willful misconduct, or any conduct that otherwise involves dishonesty, breach of trust, or violent behavior

Lenders may also provide lists of preferred notaries for their specific loan closing orders.

Notary Assignment Process through Archer®

A query is run through Archer®, Accurate Group’s proprietary vendor management system, to determine notaries by subject county. Then final notary assignment is determined based on the following factors:

- Best quality score

- Closest to the meeting location

- Best price point

Lastly, upon a notary’s confirmation of availability, details of the closing are reviewed and the assigned notary confirms understanding.

Step 2: Quality Scoring & Quality Control

Accurate Group uses feedback from lenders, closing officers and borrowers to compute a quality score for each notary vendor. The score is a range between 0 and 5 with 5 being a perfect quality score. The vehicle for gathering feedback is a survey sent to the borrower after the closing is complete.

If desired, our survey can be substituted with one provided by the lender. The survey may also be presented by the notary if requested by the lender. Survey results are entered into the system and the quality score is updated with each completed closing.

Lender-provided input supersedes survey data and may result in the removal of a notary from eligibility on future orders.

All notary orders are audited and expected to achieve a 100% quality score. Audits are performed by a member of the Accurate Group vendor management team.

Step 3: Seamless Implementation

Accurate Group works hand-in-hand with the lender, supplying communications for borrowers, guiding best practice processes via NotaryWorks and facilitating the choice of a remote or mobile notary.

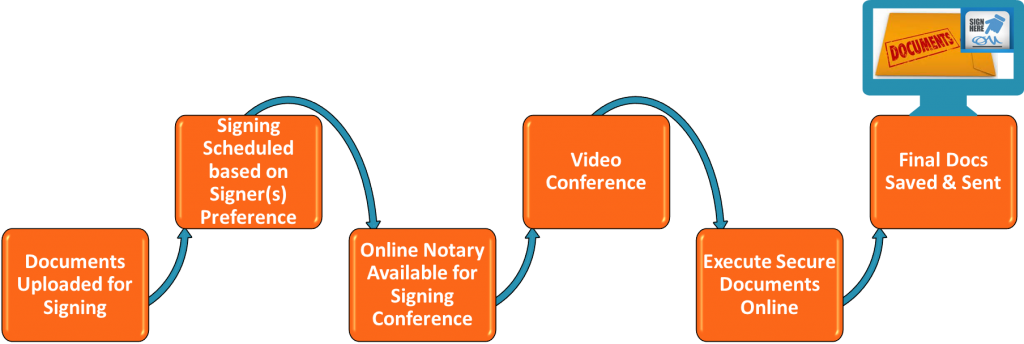

NotaryWorks is an innovative e-closing technology platform that streamlines the loan closing process, electronically brings together borrowers and notaries and improves the loan closing experience for all stakeholders.

In the competitive real estate lending environment, it is important to provide the best possible consumer experience. NotaryWorks is a user-friendly, convenient solution for all of your e-closing needs.

Contact us at askAG@accurategroup.com to learn more about NotaryWorks or to request a demo – and get on the path to faster loan closings and happier borrowers.

Back to Blog