KPMG recently published an article titled, “INSIGHT: Home Equity Interest May Still Be Deductible,” presenting its assessment of the 2018 tax law changes as it pertains to home equity lending. The following are highlights from the article.

It was originally perceived that the new tax law would be detrimental to home equity lending, but upon further analysis that perception is proving untrue. The key to determining home equity interest tax deductibility lies within a specifically defined term – “home equity indebtedness.’’

If criteria are met within the definition of this term, a taxpayer may still be able to deduct interest paid on a home equity loan, home equity line of credit, second mortgage or similar product for a “qualified residence.”

Home Equity Term Definitions

To fully understand the new tax law, it’s important to understand the term definitions for qualified residence, home equity indebtedness, and acquisition indebtedness.

Qualified Residence is:

- The taxpayer’s principle residence; and

- Any other residence owned and used as a residence by the taxpayer that is selected by the taxpayer to be a qualified residence.

Home Equity Indebtedness is any indebtedness, other than Acquisition Indebtedness, secured by a qualified residence – which means any indebtedness secured by a qualified residence of the taxpayer that is incurred in by either acquiring, constructing, or substantially improving any qualified residence of the taxpayer.

For example, if the home equity loan is used to build an addition on an existing home, the interest is typically deductible. But, if the same loan was used to pay personal living expenses, such as credit card debts or purchasing a vehicle, it is not deductible.

See our visual breakdown on how the home equity tax deduction works. Despite initial concerns, the avenues for a proper home equity interest deduction have only been slightly altered.

Bottom Line for Home Equity Lenders

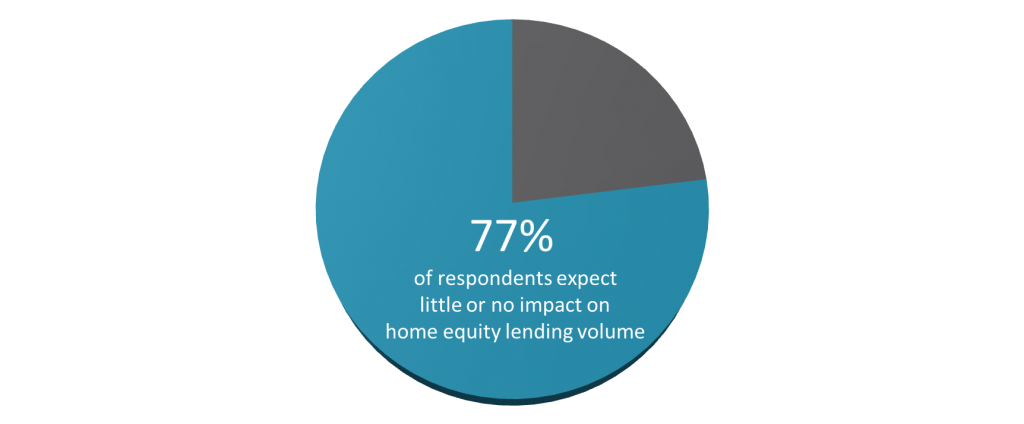

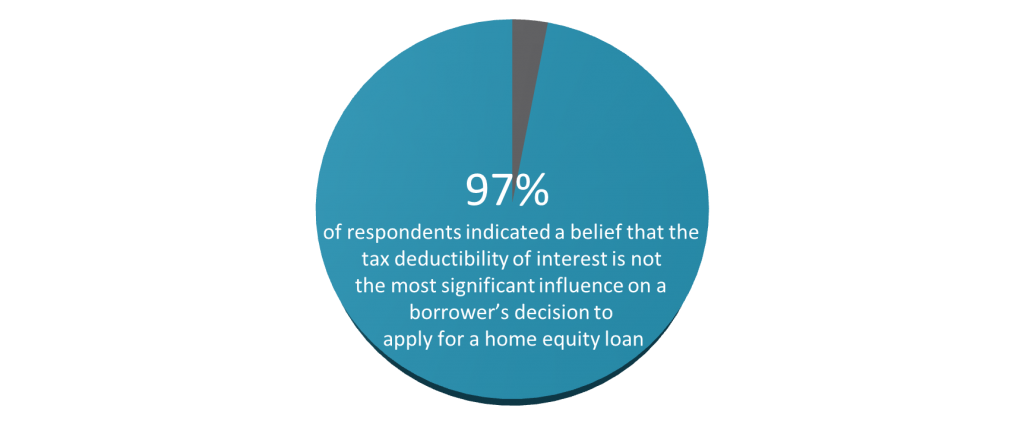

In 1st Quarter 2018, Accurate Group conducted a home equity survey of the industry’s top lending executives to determine what impact, if any, the 2018 Tax Law would have on home equity lending. Paul Doman, president and CEO of Accurate Group, shared the results during the 2018 CBA LIVE conference in a session titled: “2018 Tax Bill: Home Equity Implications.” The big takeaways from top lending executives were:

However, a majority of respondents indicated they expect borrowers to pay off or reduce existing balances faster.

‘‘Based on our survey of banks, credit unions and other home equity lenders and our dialog with the top home equity lenders during the Consumer Bankers Association’s Annual CBA LIVE conference in March 2018, we believe the demand for home equity loans and home equity lines of credit (HELOCs) will remain strong,’’ stated Mr. Doman. ‘‘Recent IRS clarification allayed many of the initial concerns lenders had about the impact of the new tax law on home equity lending, and demand for our home equity appraisal, title and closing solutions remains strong so far this year—an indicator that lenders are continuing to grow that portion of their business.’’

Bottom line, not all deductibility is lost for interest on home equity debt products under the new tax law – which is good news for lenders!

If you’re a home equity lender, contact us at askAG@accurategroup.com to learn how you can streamline your home equity appraisal, title and closing processes to maximize the profitability of your home lending business.

The information contained in this blog is of a general nature and based on authorities that are subject to change. Applicability of the information to specific situations should be determined through consultation with your tax adviser.

Back to Blog